America Is Crashing!

Urgent Warning to Every American

With a Bank Account: Do Not Invest, Deposit, or Withdraw Another U.S. Dollar

Until You’ve Seen This Report

Have you ever wondered why America hasn’t “ended” yet?

At least a dozen “experts” have predicted that America’s role as the world’s financial superpower was going to end.

I’m sure you’ve seen some of these predictions. They’ve been all over the Internet and TV.

And I’m quite sure it hasn’t escaped your notice that they were wrong.

Since 2008, we have not had a major economic collapse.

America continues.

But I’m sure you also feel somewhere deep in your bones that the gist of what these “experts” were saying is true.

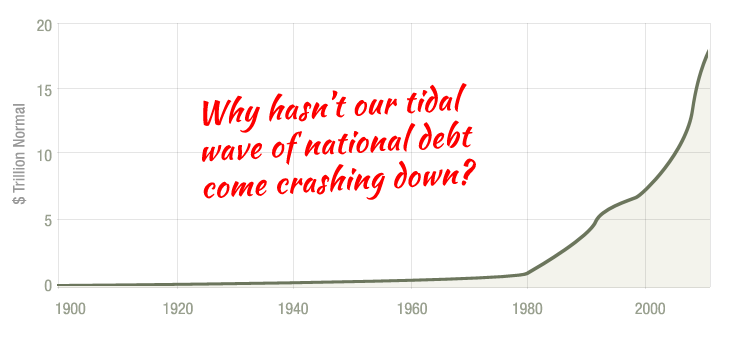

The U.S. has gotten itself into incredible debt – a debt that is growing every day. When you see graphic illustrations of it, it seems like a tidal wave that is about to crash down at any moment.

And yet, it hasn’t happened.

Why?

That is what I’m going to talk to you about today. I believe I know why America has not collapsed. I’ll tell you why that is.

You see, there’s a simple reason our economy hasn’t collapsed yet…. And it has nothing to do with the overvalued stock market…

Or the trillions in national debt…

Or the crashing oil market.

As I’ll show you in a minute, these are all important economic factors. But they aren’t the mechanism— the real root cause that can and will trigger a global catastrophe.

When historians look back at the next economic avalanche that hits America, they will see it originated in an overlooked, little-understood market…

A market that’s 40-times larger than the stock market, but that, oddly enough, some people are only vaguely aware of. And that many people don’t even know exists at all.

It’s something that touches all our lives, whether or not we’re active investors…

And every single important event that has happened in the financial world over the last 100 years…

- The great stock market boom of the 1990s

- The Great Depression

- The collapse in the Housing Market….

Have all originated from activity in this one massive market.

I’ve been studying this market for my whole career… and I know it as well as anyone. And right now, as I speak, key changes to this market are steering America’s economy and markets over a cliff.

Until now, these changes have been happening gradually. But soon, they will speed up. And many Americans will experience what I believe will be one of the worst Depressions in the history of America.

- The stock market could crash by 50%.

- Unemployment could triple—even retirees will lose part-time jobs.

- Thousands of banks could go under.

- Over 50,000 businesses could go bankrupt.

- The Government will likely order “capital controls.” Meaning, they’ll place restrictions on what you can do with your money. They may even outlaw cash altogether.

And the value of your home and all real estate could decline by at least 30%. Sounds extreme and hard to believe, I know.

But the world’s governing elite have been carefully monitoring this event. I’m talking about the heads of major banks and institutions such as the U.S. Treasury, Goldman Sachs, and the International Monetary Fund.

These elite “in-the-know” bankers and officials fear this development more than hyperinflation or even civil unrest—because it’s the one factor that threatens their power more than any other.

In fact, Janet Yellen, the head of the Federal Reserve, considers this America’s #1 threat, according to a remark she made to a small group of wealthy Californians.

That’s why I’m shooting this video today. Because I want to explain what exactly is going to happen and how you can protect yourself.

Because the fact is, no matter what your situation…

if you have a pension, 401k, or IRA…

If you have money in one of America’s large “mega” banks…

If you own stocks…

If you have debt or credit cards of any sort… you WILL be affected by this crisis.

That’s why I hope you’ll pay special attention to this presentation.

The Most Underground

Group in America

My name is E.B. Tucker. I’m a professional investor, writer and researcher.

Last year, I was recruited to join a rather unusual organization headed up by renowned contrarian Doug Casey.

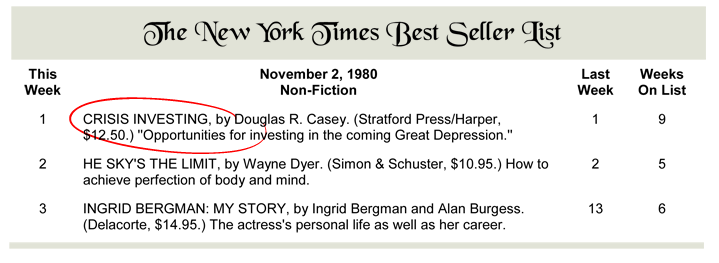

Doug, in case you don’t know him, is a legendary investor… who has made millions by shirking conventional financial advice…

Doug’s book Crisis Investing, was the best-selling financial book of 1980, spending 10 weeks at #1 on The New York Times best-seller list.

The book’s success landed him on CNN, Merv Griffin, Charlie Rose, Regis Philbin, and NBC News. Phil Donahue even devoted an entire show to his work.

Since then, he has amassed a large personal fortune, which includes property in several countries…

And attracted something of a cult following within the financial and libertarian communities.

Doug now consults with the unusual group I mentioned earlier. It’s the largest and most sophisticated financial research organization of its kind. And together, Doug and I have been tracking the event I’ve been alluding to, for a number of years now.

I’ll tell you more about this event in a minute, but first I should tell you a bit about the other events we’ve tracked over the 80-year history of our organization.

- This group predicted the recent Chinese stock market crash—26 days before it occurred… and the 1,000-point drop in the DOW that happened as a result.

- We predicted the bankruptcy of Lehman Bros, Fannie Mae and Freddie Mac in 2006. 2 years before America’s financial system melted down.

- On July 23, 2001 we predicted that Islamic terrorists would attack key buildings in New York either by car or plane. Less than two months later, the 9-11 attacks happened.

- And in 1987, we warned readers about the Black Monday market collapse—9 days before the Dow fell 22%.

For nearly 8 decades, this group has been using its financial prowess for good—by informing the public about these important financial trends before they happen.

For example, back in 1938 we warned in one of our bulletins that British Prime Minister Chamberlain’s appeasement of Adolf Hitler would only fuel the Third Reich.

And we all know what happened next. The Nazi war machine absorbed Czechoslovakia and invaded Poland.

Anyway, that’s all history.

Let’s talk about today…

We believe the video you’re watching could go down as our most important warning of all time.

So please watch carefully… take notes… and make sure you stick around until the end. You’ll learn about a protection blueprint everyone in America should have. And it contains the #1 most important thing for you to do right now to safeguard your money BEFORE this crisis hits.

Now, let me show you what exactly I’ve discovered.

The Single Most Important

Economic Force In the World

Has Changed Directions

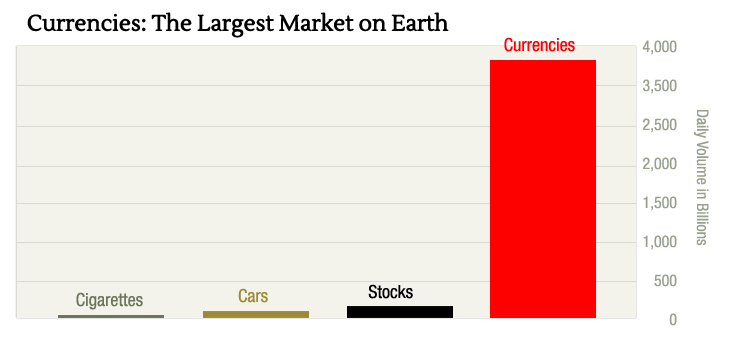

Take a brief look at this chart:

It shows the market size of several items you see—or hear about—every day.

- For example, every 24 hours, an average of $1.3 billion worth of cigarettes change hands.

- $24 billion worth of cars sell every day.

- And $80 billion of stocks change ownership.

That big bar on the right is currencies.

Currencies are the largest market on the planet. Four trillion dollars’ worth trade hands every single day.

Each and every day, there is 500 TIMES more money traded in the currency market than on the U.S. stock market!

And yet, we almost never hear of it!

Most people don’t realize this, but daily trading in this huge market of currencies affects every aspect of our financial lives…

From our homes and cars… to the coffee and milk we drink every day. And of course all our investments (stocks, bonds, options, precious metals, etc.)

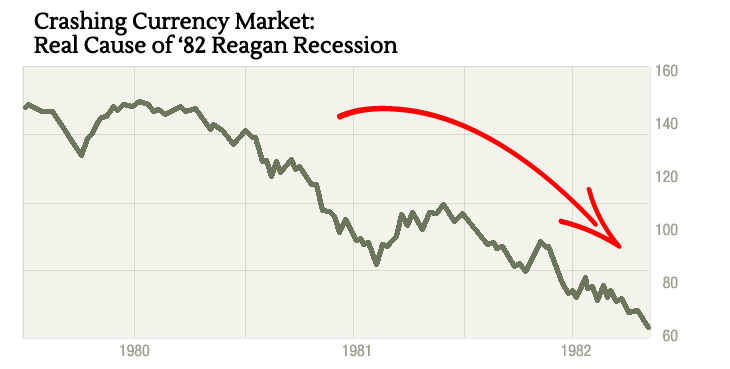

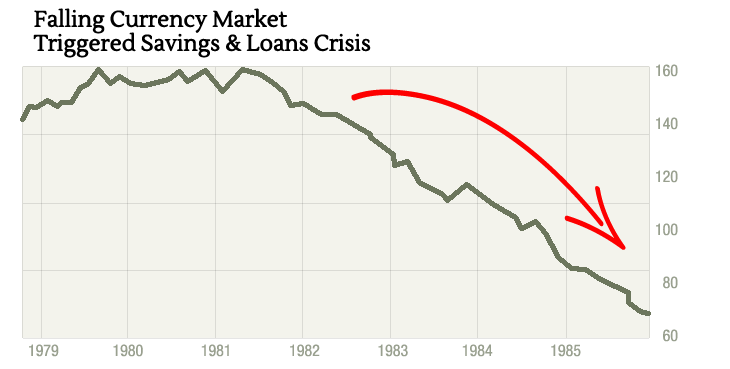

Do you remember the Reagan Recession from 1981 and ’82?

It had nothing to do with the Soviets. It had nothing to do with energy prices. Rather, it happened because the currency market “fell” by about 50%.

Once you understand the huge and interconnected power of the currency markets you will see why, for example, the price of gold went from $850 to less than $300 from 1980 to 1985.

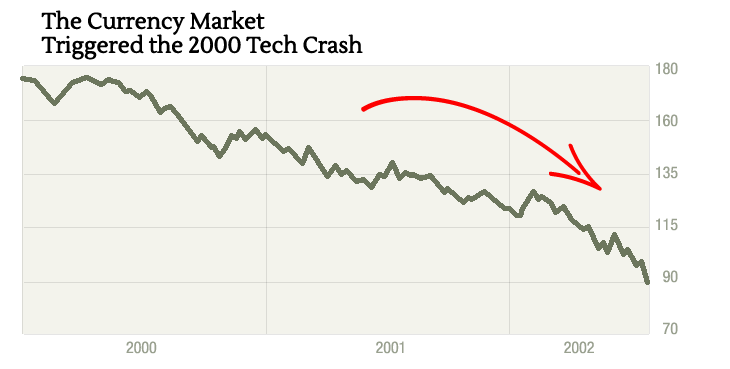

Also, remember when the dotcom boom went “bust” in 2000?

And the recession we experienced a year later?

Most people (even financial journalists) said “excessive speculation in the stock market” caused it.

But that’s not the case….

The tech market came crashing down because the currency markets fell by 50%.

Why does the currency market have such a big impact on everything in the financial world?

I’ll show you in just a moment…

But bottom line: If you know which way the currency market is heading—you can predict what will happen to everything else…

Commodities… the economy… the job market… your bank account…your stock portfolios… your retirement accounts and so on.

Many big-name gurus—even billionaire investors—have been predicting America’s demise for the past 20 years. But they’ve all been wrong.

They’ve been focusing on the wrong indicators. And they’ve overlooked this one, central fact.

Today—and I’ll explain why—the currency market is falling. Once again, it will produce a cascade of crashes and bankruptcies.

But this time, the outcome should be far more devastating than the examples I just showed you.

Let me explain…

Once You Understand How

Powerful the Currency Market Is,

It’s Easy to Predict What’s

Happening Next

You see, over the long run, when the currency market starts moving in a certain direction, it tends to move that way for a long time.

The reason for that, now that we have all this data to look back on, is obvious. It is a question of size – that is, the immense size of the currency market.

It takes a while to turn around and change directions. But once it does, it stays that way for a while. And a predictable set of things happen.

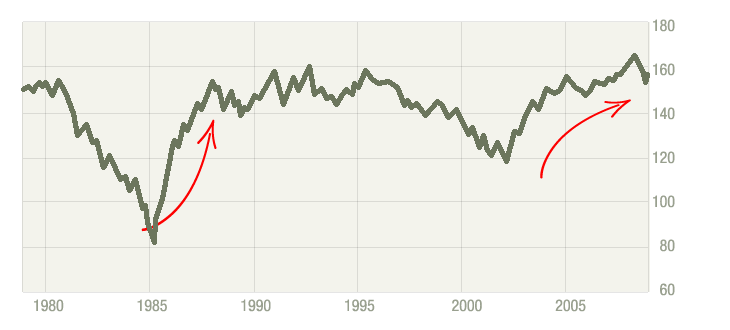

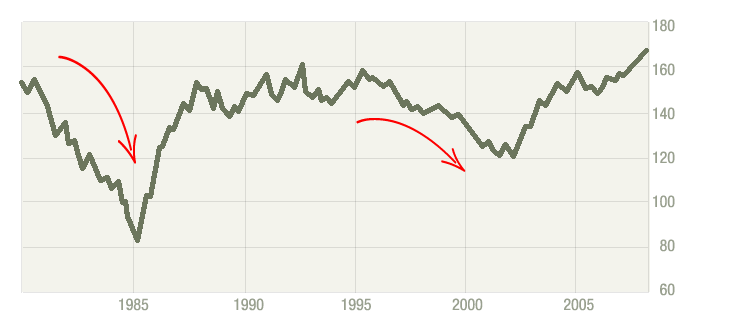

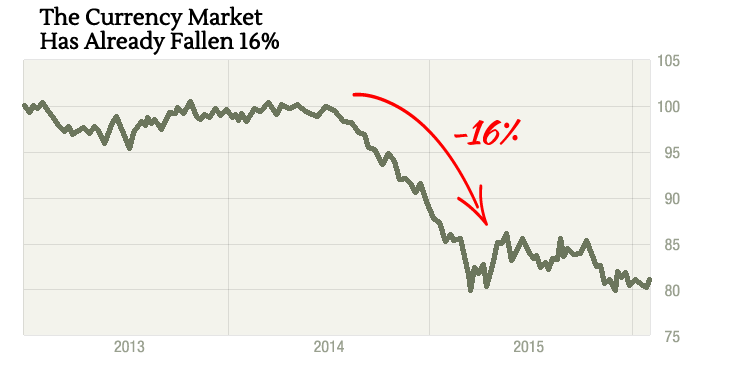

Here, take a look at this chart:

Over the past 30 years, there have been two major episodes when the currency market increased in value…

From 1985 to 1993… and from 2002 to 2008.

And also two major trends when the currency market fell in value

From 1978 to 1985…and from 1993 to 2002.

Simply put…

When these trend changes takes place… it’s like a huge tectonic shift under the markets. Everything behaves differently.

To give you one example…

When the currency market rises in value, an economic boom in America and abroad usually accompanies it.

It’s easy for investment professionals to make money. And there’s a feeling of prosperity in America. (We saw this from 2002 to 2008.)

Commodity prices soared. That’s also in large part why the stock market soared. Because people had more money, and naturally a lot of this money flowed into the stock market.

This cheap money fueled a massive bubble, which popped in the crash of ’08. That’s because this isn’t “real money,” in a sense. It’s borrowed money. And people tend to speculate more when they have extra money and see markets rise.

When the currency market changes trend and starts falling again, the economic boom ends.

We experience problems at home… and many countries overseas go broke. Corporations default. So banks and governments stop lending money. Commodity prices plummet too.

We’ve seen a few glimpses of this in modern America….

From 1980 to 1986, the currency market fell nearly 50% in value. It was horrible for the U.S. economy. In 1982, business bankruptcies rose 50%.

Not only did banks stop lending, over 1,000 went bankrupt. This “tightening” set the conditions for the Savings & Loan crisis, which hit America hard a few years later.

Had the Federal Reserve and U.S. government not intervened, this crisis could have turned into a full-blown depression.

In short, when the currency market falls, money lending gets tight… and the economy contracts.

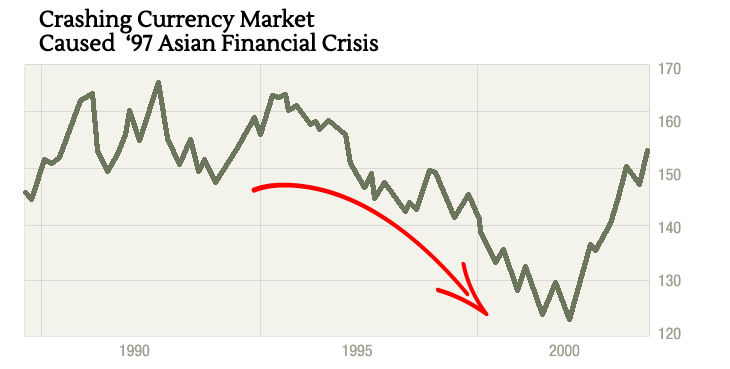

We briefly saw the effect of a falling currency market in the late 90s too.

The currency market was crashing. And it triggered the Asian financial crisis, which almost toppled Wall Street.

Again, the Federal Reserve and U.S. Government intervened. They prevented what might have become a full blown, worldwide catastrophe.

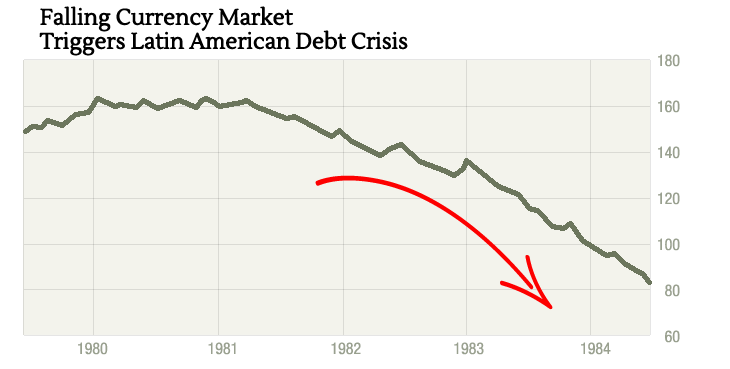

Right here in the early 1980s, the currency market began falling in value, and the Latin American debt crisis occurred.

Now… let’s jump to 2008.

Our group was watching the currency market, and we realized its “direction” was about to change. After rising for 7 years, it was about to head the other way.

How did we know this?

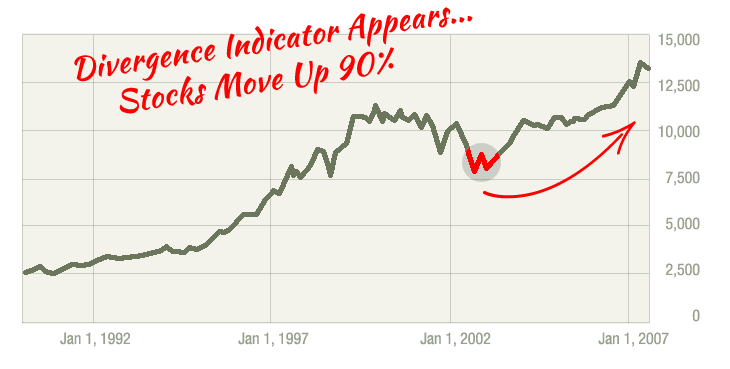

Because a “divergence” appeared in the currency market.

Here’s what that means in simple terms:

The entire world thought the currency market was going to rise… but it wasn’t behaving the way you’d think it would. It was showing signs that it wanted to fall instead.

It’s kind of like a suspect in a police interrogation who says one thing and fools most people. But the trained eye can always detect those little facial expressions that betray the truth.

The market is similar. Stocks dance and sway a certain way, but the market has certain ticks and tells that give it away.

This divergence indicator is just one such pattern we follow—and it’s something we’ve tracked for decades…

We noticed it in the stock market in 2003—around the time America invaded Iraq.

At the time, the world was full of fear, and many thought it was a sure thing that markets would crash.

Yet, the market “diverged” from what people were saying. The market began moving higher in the face of utter pessimism. Our indicator told us this would happen—that stocks would rally.

And over a 5-year period, the U.S. stock market rose by more than 90%.

In 2008, we saw the same scenario appear in the currency markets.

At the time, everyone thought the currency markets would rise. Yet, we were beginning to detect early technical signs that it would fall.

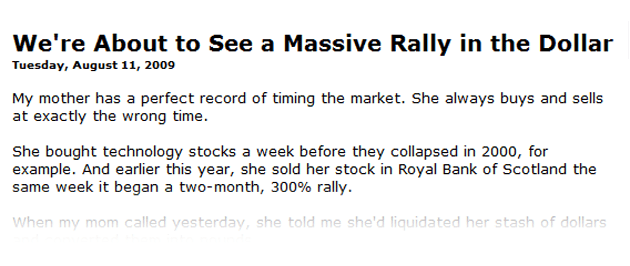

Our group wrote several articles about this shift…

Here’s one from 2009:

And another one from 2010:

We predicted this currency shift would begin slowly… and speed up over time. We knew it would change the way we experience everything in this country—work, life, real estate, retirement….

As expected, it took a while for this trend to pick up steam, as these things do…

You see, the currency market is like an oil tanker: it takes a while to turn around and change directions. That’s because the dollar is a huge market—the largest in fact in the world. And it’s not subject to the “emotional swings” that smaller markets (like stocks) experience.

But once it does change direction, it picks up steam—and there’s no stopping it.

By 2013, we were so certain that we were right and that the currency markets were crashing that some of our analysts started placing bets with their own money on this.

And look what happened…

As you can see, the currency market has already fallen by as much as 16%. (In fact, one of our analysts already quintupled his money from moves he made in anticipation of this trend.

What we see now is as clear as daylight:

The currency market has experienced a generational shift.

It is falling in a big way, in a major way. And all the history of data tells us that this new trend will continue for many more years.

(I’ll show you in a minute…)

This new shift is a very big deal and it’s going to affect the price of every single stock, commodity, and bond around the world.

It’s going to affect the prices of houses… even toys, cars, power bills, gym memberships, rounds of golf, household goods, diapers….

And every investment you make, large or small.

What We Are Witnessing Is

the Biggest, Most Important

Trend Change in the History

of Modern Capitalism.

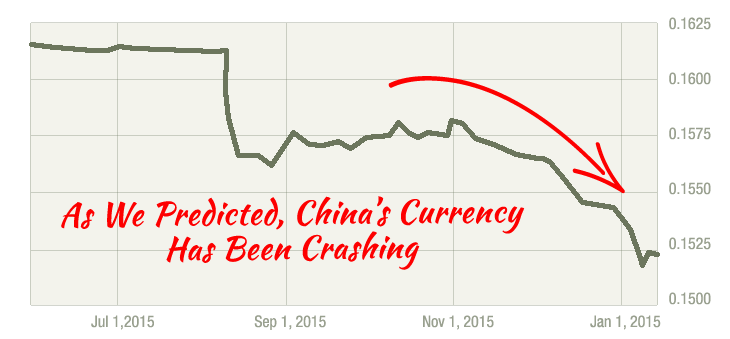

Not only were we right about the currency market, things that we knew would happen as a result have also come true…

We knew what would happen because, as I said, the currency market has a very predictable effect on all of the world’s markets and economies.

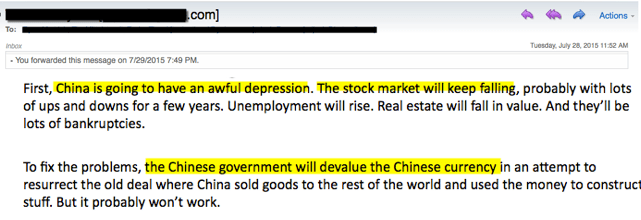

For example, this past summer—because the U.S. Dollar had experienced such a big move—we knew China would suffer. Their economy is very sensitive to the Dollar. We told our colleagues at the time what I thought would happen:

We predicted that China’s stock market would crash and they would devalue their currency.

And that’s exactly what’s happened.

Here’s a shot of China’s currency:

We also warned my colleagues and readers about a shock to the stock market in the U.S.

8 days later, it happened.

In a week and a half, the S&P—a popular grouping of companies in the stock market—lost $2 trillion in value.

And as I’ll show you in just a moment, it’s going to get much worse.

As you can see, once you understand the currency cycle, it’s almost like being able to predict the future.

But these events were merely a warning shot…

Doug and I now believe—and our analysis supports this conclusion—that this most recent shift in the currency market has put into motion a major trend in all of the other, smaller financial markets, and that this is going to affect the American economy (and all others) in a devastating way.

For most people, those that are getting their information from the mainstream financial media, it’s not going to be pretty.

I hate to use the phrase, since so many others that were incorrectly looking at smaller markets to make predictions have been wrong so far, but what I see coming is quite possibly the worst Depression in the history of America.

The early warning signs are all around us.

Let me show you 3 we’re tracking…. And exactly how things will get worse.

Early Warning

Sign #1

Today, the credit markets are drying up—just as they were in 1837, 1893 and during nearly every other major American depression.

U.S. corporations are defaulting on loans faster than at any time since the recession of 2008….

During the first 6 months of 2015, 52 companies defaulted. That’s a default rate that’s double the year before.

Meanwhile, subprime auto borrowers—much like the risky mortgage borrowers from 2006 and 2007—are defaulting at the highest rate since ’08.

Banks are even taking away credit from prime and super-prime consumers. (These are borrowers with the best credit scores.)

Since 2011, the average credit line for people with credit scores over 780 has dropped more than 20%.

This “credit squeeze” is spreading to America’s biggest industry too…

For years, while money was cheap… and the amount of currency available in the world was rising… a credit bubble formed in the oil and gas industry. People lent and borrowed freely.

Banks lent hundreds of billions of dollars to drillers, explorers and producers in the oil and gas industry.

The debt these energy companies have taken on has become more and more burdensome to carry. A falling currency market has “popped” that bubble.

Across Texas and North Dakota, oil companies are already declaring bankruptcy…

Like Sabine Oil & Gas Corp, one of the bigger names in the energy business. Saratoga Resources, Dune Energy and American Eagle Energy Corp have all declared bankruptcy.

The big U.S. banks that lent these companies money are taking away their credit lines…

And they’re setting aside money in case these energy loans continue to go bad.

Bank of America, for instance, has lent out 46 billion dollars to the energy industry. Now, they’re setting aside an extra 15% of their capital to deal with bad energy loans.

JPMorganChase has set aside an extra $160 million… to protect themselves.

According to the Federal Reserve, 80.2% of banks have said they’ll take away credit lines from the oil and gas industry in the year ahead.

But this is just one warning sign…

Early Warning

Sign #2

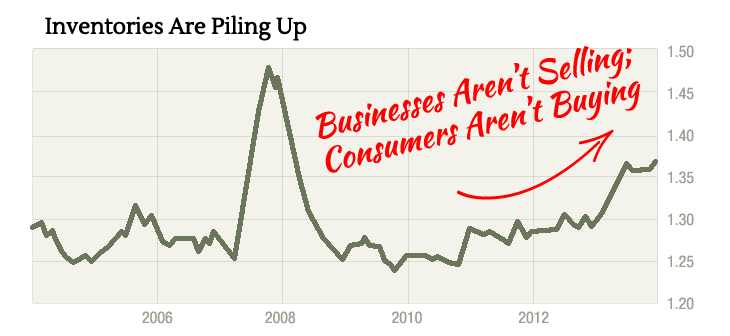

Inventories are piling up too…

Here, take a look at the “inventory-to-sales ratio.”

It shows how much product U.S. businesses have in their warehouses. If the number is high, it means they’re not moving a lot of product.

As you can see, the level is at the highest it’s been since the recession in 2009. In short, American businesses are selling less. The consumer is buying less. And inventories are piling up in warehouses.

A big reason for this: People are hoarding what money they have.

Early Warning

Sign #3

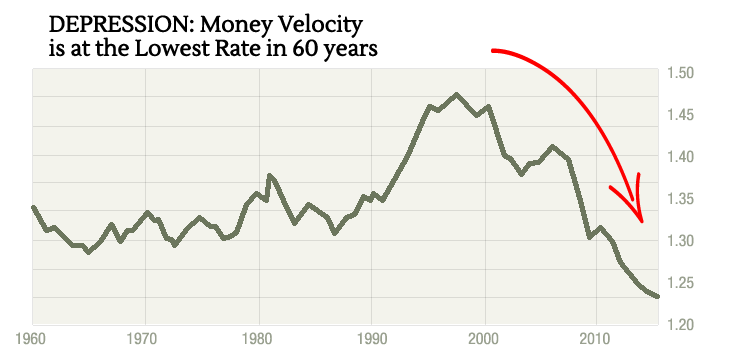

You can see this in a chart of what’s called “Money Velocity.”

Money velocity measures how fast dollars are spreading through the U.S. economy. The lower the velocity, the less people are changing money.

Here, take a look:

As you can see, money is not changing hands. The Government has pumped trillions into the economy, but banks aren’t lending it out. And individuals and businesses are hoarding the money they have.

Bottom line, as the currency market continues to crash… the U.S. economy will continue to contract. And the American consumer and investor will lose confidence.

It’s a devastating spiral—and we’re already stuck in it.

Let me show you what this will look like over the next few years. And in a moment, I’ll show you what I’m doing to safeguard my savings and capital. I’ll also share a few places you can expect to make huge fortunes as folks panic and abandon treasured assets…

An Unconventional Alliance

As I mentioned, my research partner, Doug Casey, and I are part of an unusual group.

It’s actually the largest independent organization of financial publishers in the world.

The name is hardly known except to financial insiders: Agora.

In Ancient Greece, the Agora was the place where business people came to exchange goods and intellectuals came to discuss ideas.

The association is not accidental: Agora’s founders are big believers in freedom: freedom of faith, freedom of trade, freedom of speech and the freedom to make and safeguard one’s wealth without government interference.

Our research reflects those ideas.

Today, if you walk into any of our buildings, it might surprise you to see the types of people who work for us:

- 9 authors whose works have topped charts at the Wall Street Journal, the New York Times, Amazon, and Business Week.

- An epidemiologist and Senior Investigator at the National Cancer Institute.

- A reclusive billionaire and author of 3 best-selling books on the collapse of America.

- A former 3-term Congressman from Maryland.

Our members have appeared in and written for hundreds of the world’s elite media organizations:

The Financial Times, The Guardian, MSN Money, Market Watch, PBS News hour, The New York Times Magazine, Investor’s Business Daily, Entrepreneur, Fortune, Business Week, The Economist, Worth, The Wall Street Journal, Barron’s, Bloomberg, National Review CNN, NBC, CBS, BBC, Bloomberg TV, Fox Business Network and over 80 newspapers, including the New York Times and the Washington Post.

In short, we’re the largest organization of writers, thinkers and researchers you’ve likely never heard of.

Today, Doug and I work for an Agora affiliate—the research firm he founded: Casey Research.

And together we’ve been monitoring the events I’ve described so far.

That’s why recently we’ve taken certain steps to prepare for what’s about to happen next.

If these events come to pass, there won’t be enough warning for most Americans….

Let me show you what I suspect we’ll see…

Do You Live Near Any

of These Cities?

When you tally all of the places we’ve been to…

Doug and I have traveled to 165 countries and hundreds of cities.

This is the most tense piece of land in the world…. North and South Korea keep guns pointed at this strip of land 24 hours a day. One step over the line means you’re in North Korean custody.

This is the most tense piece of land in the world…. North and South Korea keep guns pointed at this strip of land 24 hours a day. One step over the line means you’re in North Korean custody.

“That’s me (E.B.) 20 feet into North Korea…inside one of those blue buildings.”

“That’s me (E.B.) 20 feet into North Korea…inside one of those blue buildings.”

Doug Casey meeting Castro, upper left (Photo courtesy of Paul Zyla)

Doug Casey meeting Castro, upper left (Photo courtesy of Paul Zyla)

Over the past decade, we’ve seen these places grow richer—even as our country’s debt grew.

Yet, in the years ahead, we expect to see the opposite happen…

In America’s supermarkets we’ll see gaps on the shelves where we used to see tomatoes, corn, and grapes.

According to Bill Northey, Iowa’s secretary of agriculture, “There are tighter times coming. Some farmers will be upside down.”

In America’s oil patch—across North Dakota and Texas—we will see oil bubbling to the surface… but no one to work the equipment.

In fact, we’re already seeing an exodus from all the new hotels, trailer parks, and restaurants that have popped up to accommodate oil workers over the last 5 years.

Today, the Mall of America in Bloomington, Minnesota is the country’s largest shopping center. It has a 1.2 million gallon aquarium. Roller coasters. An NHL-sized ice rink. The facility employs over 13,000 Midwesterners.

As the currency market continues to fall… and the credit market and economy contract… people won’t be buying iPads and head massagers in shopping malls. They’ll be paying down debt and socking away “rainy day” money.

The Mall of America has over 500 stores today. Soon, I expect to see at least half of the retailers pull out of the mall.

The Triple 5 Group, the mall’s owner and operator, will begin thinking of ways to unload or repurpose the 7.9 million square foot property.

If you think this scenario is a stretch, just consider the Randall Park Mall in Ohio.

Photos courtesy of Nicholas Eckhart

Photos courtesy of Nicholas Eckhart

At a glance, it looks like you’re stumbling onto a building abandoned decades ago.

But the mall only shut down in 2009. Sales had fallen to the point that North Randall couldn’t even pay its property taxes.

The Galleria at Erieview mall in Northern Ohio is suffering the same fate. When I visited in 2014, they were renting out the food court for weddings.

The mall’s owners have to. No one shops there anymore. In 2005, Galleria had 70 full tenant spaces. When I visited, the mall’s business directory only listed 21 businesses.

Malls are dying everywhere in America. People aren’t spending money.

Just consider these facts:

Last year, JC Penny, a staple in many American malls, closed 40 stores. They plan to close another 47 this year.

The Gap is closing 175 stores.

Aeropostale, another popular mall store, is closing 175 stores.

The list of closure is long and serious. But you probably get the point. The collapse I speak of is not in the distance. It’s happening.

On the West Coast—in Silicon Valley—you’ll see a similar scenario unfold.

Today, it’s home to most of the country’s tech giants…. and one of the wealthiest areas in America.

In 5 years, half of the new tech companies will no longer exist. Their buildings may still stand in 2020, but they’ll be boarded up and empty. Others will merge.

The DC-Virginia area may get hit even harder.

As this crisis forces Government to tighten spending, this area will suffer.

The DC beltway is usually gridlocked with commuters as early as 6AM during the week. Soon it will soon be easy to drive during rush hour. Entire Federal Offices and Departments will shut down.

But I haven’t told you the area of the economy that will get hit hardest of all.

Do you remember how bad the last stock market crash felt? What’s coming in the next year or two will be 2-3 times worse.

The currency market wasn’t driving the crash of 2008.

It is now…

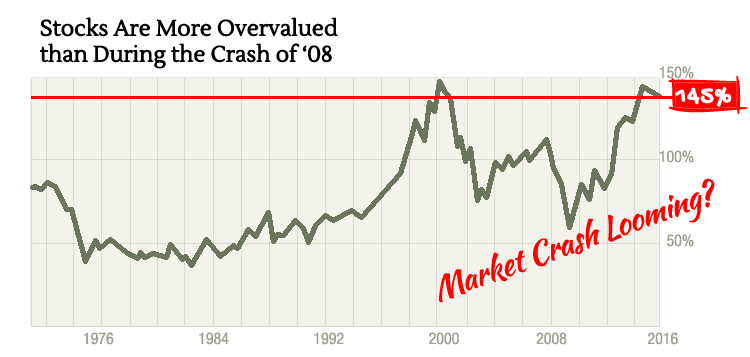

Today even after the recent “downswing”—the U.S. stock market is still overvalued.

Here, take a look at this chart:

It shows “Total Market Capitalization” compared to America’s GDP.

In other words, it’s the total dollar value of ALL the stocks in America compared to the size of our economy.

Every time the value of the stock market rose higher than America’s GDP, we’ve seen the stock market crash.

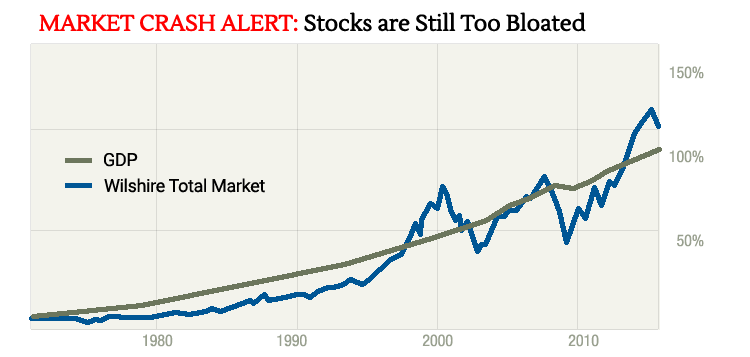

Take a look here:

The blue line—labeled “Wilshire”—represents the U.S. stock market. The green line is America’s GDP.

As you can see, in the late 90s, the blue line crossed over the green line.

Soon after we saw the tech crash.

The same thing happened in 2007. The stock market crashed soon after.

The size of the stock market exceeded America’s GDP a couple years ago.

Over the next couple years, the DOW could fall from its current levels of 17000 t0 9000 or even lower.

That would cut $10 trillion from the U.S. stock exchange… and make the ’08 crash look like a “tremor.”

Hopefully at this point you can see what’s happening here…

When the currency market rises… money is easy and times are booming…

When the currency market falls –as it has – the cost of borrowing and lending money escalates…

And bad things happen.

Businesses go bankrupt. People lose jobs. The economy suffers. Banks lose money. Credit dries up. Markets crash.

It’s why many of the “in-the-know” people I referenced earlier are preparing.

According to former hedge fund manager, Robert Johnson, many of the financial elite are buying getaway planes, airstrips, and farms in remote places like New Zealand. They may tell their private clients that everything is “OK”… but their own actions suggest otherwise.

Hollywood Director James Cameron moved his entire family to a 1,067-hectare farm in New Zealand.

And American billionaire John Malone bought a retreat on the Quebec border as an insurance policy in case “things blow up here.”

Sounds great for the wealthy elite. They have millions to burn. But what about the rest of us?

Well, I’ve assembled the details of a plan that many of us have put into place in our own lives. We’d like to share it with you… if you’re interested.

It’s not the same “blueprint” you’d use if you were planning for inflation—or the type of crisis we saw in 1950s Britain or 1970s America.

Doug and I have tailored this plan for a “deflationary depression.” It’s the type of economic scenario I’ve been telling you about in this presentation.

During the last 3 deflationary depressions, the “survivors” used a similar blueprint to protect and grow their wealth.

The plan consists of several straightforward, easy steps. They don’t cost much time or money to put into place. In my opinion, they’re essential to anyone who has a dollar to their name in the years ahead.

I’ll tell you about them in just a moment. But there’s one more piece of information I promised to share with you first…

The U.S. Government

No Longer Has the Power

to “Postpone” this Crisis.

You see the Federal Reserve and the U.S. Treasury Department have only a couple real tools they can use to “fiddle” with the economy.

They can essentially “print” money.

And they can raise and lower interest rates.

They’ve used these tools over and over again in the past to “prop up” the U.S. economy… and in some cases to stave off depression. These measures have worked up to this point.

But the Fed’s “tools” no longer have power. And the situation that’s unfolding this time is different than anything they’ve ever faced.

As the events I’ve described to you in this presentation begin to unfold…

The Federal Reserve will once again try to “soften the landing.” They’ll break out their magical toolkit… and they’ll find their tools have no power.

I already showed you that chart on money velocity. The Fed has pumped $3.5 trillion into the banking system. But that money is not circulating through the economy.

In other words, their main “tool” to manipulate the economy is no longer working.

Their next “tool” is fiddling with interest rates. When the Fed cuts rates, they’re trying to give a boost to the U.S. economy. Lower rates make it easier for people to borrow and spend money.

The Fed recently raised interest rates by a quarter of a point. But here’s the thing…

Over the past few years, rates have been rising on their own:

- Since 2013, the 30-year rate has risen as much as 38%.

- And the 10-year rate has risen as much as 91%.

What does that mean?

The Fed’s second tool has no power.

Economist Robert Prechter calls it the “Potent Directors Fallacy.” The Federal Reserve only has an illusion of power. The markets move on their own. It doesn’t matter what the bureaucrats say or do.

Bottom line… the Government and the Fed don’t have the power to stop this collapse from happening.

And while I can’t promise you its trajectory and damage will be exactly what we’ve been charting…

I feel confident enough to move my money into the ideas I’m about to share….

There Are 3 Actions

That You Should Consider

Taking Right Away.

Step One is what I call

“HIDE SOME MONEY.”

In 1929, U.S. banks had made risky loans and bad investments. When the markets crashed, they suffered major losses. There wasn’t enough cash to go around.

If you had all your money in banks, you couldn’t access your cash…

Many people lost all of their savings.

I can see something similar happening in today’s America—even with the FDIC in place. Can you imagine a world where you can’t access your own money?

I can… and it’s disturbing:

I can see banks shutting down. Savings accounts that once held money now displaying a zero balance. ATM’s that say “Out of Order.” Even worse, because the Government was so cash-strapped in the 1930s, they confiscated savings from many Americans.

The same thing is already happening today. Government and central banks are putting plans in place right now to hijack our retirement money.

That’s why we spent the past two years creating Casey Research’s Handbook for Surviving the Coming Financial Crisis.

Inside this 144-page, hardcover book, you’ll learn our best ideas on protecting your money during a financial crisis.

- Details on the one country that has never, EVER had a bank failure. It’s still easy for Americans to open an account here. Plus two of the best banking options in this country. One, for example, is a full service retail bank that has been in business since 1935 and is one of only a few in the world to offer savings accounts tied to the price of gold and silver. It also happens to be one of the safest places in the world to bank. You can open an account here starting with just $400 (page 124).

- You’ll also learn about a special type of account that can crisis proof your savings. If the Government gets creative and desperate, and begin “taxing” and confiscating hard-earned American wealth, your money will be practically invisible and untouchable here. It’s a secret that first spread to the States in 1971 in Wyoming. Since then, it has quietly spread in popularity among folks who value privacy and protection from the U.S. Government (page 67).

- Most people have heard about IRA’s. They give you tax advantages and freedom to invest in a lot of places traditional accounts don’t give you access to.

But almost know one knows about a special type of self-directed IRA that lets you reap the benefits of these accounts… while eliminating almost all of the annoying paperwork… and shielding your money from the prying eyes of the U.S. Government. You’ll find out all the details on (page 62).

Inside this book, you’ll learn about these 3 tested methods. We’ll also show you nearly a dozen other ways we recommend to stash some cash outside the banking system… and beyond the reach of the Government.

Friends and family may call you “extreme” for making some of these moves. But they’re the ones who will be asking for your help when the banks deny them access to their money.

Stay tuned until the end of this presentation. I’ll show you where to enter your information to claim a free copy.

The second step is what I call

“TAKING PROFITS.”

You might think it’s impossible to make money during a major economic crisis, like the one Doug and I believe is heading our way.

But let me show you just one way.

During the Great Depression, the U.S. stock exchange fell more than 60%.

Almost every company and investor lost a lot of money.

Yet, a certain type of stock did extraordinarily well.

Homestake Mining was one such company. From 1929 to 1933, the company shot up 474%.

Had you invested $10,000 in the stock while the markets were crashing, you would have made $37,000 in just 4 years.

Dome Mines did even better…

Over the same period, the stock shot up 558%. It multiplied every stake nearly 5-fold.

How was this possible? What did these businesses have in common?

Gold.

They both mined or produced gold, which is the #1 asset to own during a crisis. It’s a great way to store your wealth… and make your money immune from bank crashes and government seizures.

It’s also a fantastic asset for generating new wealth—and income too.

At Casey Research, we’re big fans of gold. We all own loads of gold in various forms—bullion, coins, stocks… you name it.

For example, Doug owns millions of dollars in just gold stocks. That’s not counting his other gold holdings.

That’s why we distilled the best gold ideas we’ve ever come up with and put them into a 63-page book I’d like you to have for free. It’s simply called The Gold Book.

Inside, you’ll discover:

- The gold investment that climbs 2-3 times more than the price of gold.

- The 3 best hunting grounds for “gold juniors” — these are small gold stocks with the potential to rise 500% or more.

- The secret technique that lets you grab gold shares at 20-30% below market prices.

- How to generate capital gains and gold dividends—even when gold prices are falling.

- A simple way for Americans to store gold more than 9,000 miles from the States… in a country that has never confiscated gold. This mint is AA-rated by Standard & Poors (meaning it’s incredibly safe). And because you can open an account from the U.S…. it’s convenient too. If you happen to travel to this part of the world, you can take a look in the vault at your gold, any time you want.

You’ll learn about these opportunities, and much more, in The Gold Book.

The ideas in this book can protect your nest egg during a deflationary depression, like the one I’ve been telling you about…

And double or even triple the wealth you generate each year.

We don’t sell this book anywhere. And I can guarantee you won’t find these ideas anywhere else.

I’d like to give you access to the Gold Book, as well as our crisis survival book, for free.

Let me show you why… and how you can access your copies…

The Real Trigger Behind

America’s Coming Collapse

For the past 7 years or so, while most “gurus” have stayed on the sidelines… my colleagues and I have shown our readers how to put their money to good use.

Here’s a snapshot of the recommendations we’ve made at Casey Research since the crash of 2008:

- Black Diamond Group Limited: 51%

- Celsion Corp:166%

- Detour Gold 230%

- MannKind Inc: 185%

- Fortinet Inc: 102%

- Osisko Mining 260%

- Lordos Hotels: 210%

- MAKO Surgical Corp: 138%

During that time, the U.S. Government borrowed $8 trillion, almost doubling the national debt. Every time our debt levels reached new highs, investors and retirees panicked.

I knew we weren’t in any danger…

But now, with the currency market crashing… it’s like dumping kerosene on a forest fire.

If you’re not taking steps right now to protect your savings, you will absolutely lose money in the years ahead.

The ideas contained in these books I mentioned will keep you safe and protected… and have the potential to increase your net worth as well.

You’ll get free access to this research right away:

- Casey Research’s Handbook for Surviving the Coming Financial Crisis.

- And The Gold Book

When you take a trial subscription to our monthly financial newsletter, called The Casey Report.

Doug wrote his first newsletter in 1979. Since then, tens of thousands of folks around the world have joined us as subscribers.

Like Jim Galland, who told us the first dollar he invested on our recommendations is now “up over 1,000%!”

- In February 2001, Doug told our subscribers that silver would enter another bull market. At the time it was trading for $5 to 6 bucks an ounce. By April 2011, it hit $51 an ounce—a nearly 10-fold increase!

- In May 2012, we identified a group of dangerous ETFs and warned our subscribers to stay away from them. As you probably know, exchange-traded funds or ETF’s are popular among retirees and safe investors. Since our warning, one of these funds, GDXJ, fell 65%. Another ETF—the United States Oil Fund—has fallen 72%! And yet another—United States Natural Gas—has fallen 62%.

- In August 1996, we were one of the first in the country to tell people to get into commodities. We said a major bull market would be getting underway. That call was spot on. In the decade that followed, commodity prices multiplied by 5-10 times.

- In September 1999, we warned the tech bubble would burst, which it did six months later in spectacular fashion.

In short, if we find an idea that we would use or tell our family and friends about, we’ll tell you too in The Casey Report.

Before I show you how to start your trial subscription, there’s one more step in our plan to tell you about…. And one more bonus I’d like to give you for testing our work.

STEP 3:

Your “Day After

Shopping List”

Some of the greatest fortunes in modern economic history have been created from buying at the very bottom of a crisis.

Consider Wilbur Ross, Jr….

As the tech bust bottomed out, so did prices of many businesses. Ross went on a shopping spree, buying steel companies and textile companies on the cheap…

His firm’s holdings have risen 20-fold since the early 2000s…. and Ross himself has amassed a $2.9 billion fortune.

So, what do you do if you’re not a billionaire?

Well, right after the ’08 crisis, for example, you could have bought stock in Starbucks and made more than 1,900% on your money. Or, you could have bought shares of Apple in late 2008 and made as much as 966%.

During the crisis I’ve been tracking, you’ll have plenty of opportunities to buy solid assets at 50 and 60 cents on the dollar.

We’ve created a “shopping list” of the 10 best trophy assets to track.

These companies own valuable assets in commodities like coal, oil, timber, and copper.

Don’t buy the businesses on this list just yet….

They will continue to fall in value in the months ahead. But when they hit our “buy prices,” make sure you own some if not all.

You could make 2, 3, and 4 times your money as their stock prices rebound.

You’ll find all the details in our Day After Report. I’d like you to have free access to this report for trying a subscription to The Casey Report.

Our newsletter arrives in your inbox on the second Thursday of the month.

You can access it and an archive of over 92 issues and special reports at our subscriber-only website.

If you’ve never read a newsletter before, I’m not surprised. Most people haven’t. Newsletters are not “mainstream.” You won’t find them at an airport kiosk next to Golf Digest and Bloomberg magazines.

Yet they’ve been around since 1882, when Charles Dow created the first investing newsletter.

The ideas newsletters contain—at least in mine—are a bit “alternative.” You won’t hear about them on a watered-down TV news show. Sometimes, Doug and I will spend months carving out a single idea before sharing it with the world.

So far, our subscribers tell us they’ve been prospering from this approach.

Over the years we’ve received notes from subscribers who have used Casey Research’s strategies and made:

- 50% in one year

- A “double” in 6 months with gold

- A “Triple” in one year

- “$36,000!”

- “$17,000 in one year.”

- “130% gains”

One of our subscribers, Louis Campbell, made 3,420% on Doug’s recommendation of a company called SurAmerica in 2006.

That’s like taking $10,000 and multiplying it 34 times! You’d be sitting on a pile of cash worth $342,000.

But you should see for yourself….

When you subscribe to The Casey Report, you’ll receive our 3-part plan for surviving and prospering in this coming crisis.

- Step 1 is “HIDE SOME MONEY.”

Our book, Casey Research’s Handbook for Surviving the Coming Financial Crisis will show you some clever ways to protect your savings. - Step 2 is “TAKING PROFITS.”

Inside our Gold Book, you’ll find easy directions on how to make money and collect income—even as this Depression hits the U.S. economy. - In Step 3, you’ll receive what we call a “Shopping List” in the Day After Report.

You see, the richest investors in history made their fortunes right after a crisis. You can pick up great deals—valuable companies and assets for pennies on the dollar.

You’ll get our list of the top 10 plays to invest in when the markets bottom out. And as a subscriber, you’ll hear from us the moment the time is right to buy these investments.

All of these bonus books and reports are yours free, when you take a trial subscription to The Casey Report.

I’ve mentioned a “trial subscription” several times. What I mean is this:

You have 2 full months to “test drive” The Casey Report. Make sure you read our work…and dig around my website. If you feel at any point in those first 2 months that my work isn’t right for you, then I’ll refund every penny you paid. You can keep the books and reports, our compliments.

The event headed our way is real and demands your immediate consideration. Most Americans aren’t aware of it. They need to be. The debt situation is finally, after many decades, a real issue.

In this video, I’ve proven to you the chain reaction that leads to disaster. Currency changes cause the credit markets to dry up. Markets crash. And economic depressions occur.

The ideas I’ve told you about can absolutely protect your wealth, make you rich, and grow your income—no matter what happens.

Join Doug and me today and the other 30,000 subscribers around the world. We’ll face this development together head on.

Just click the button below. It’ll take you to a sign up page where you can review all the details I’ve told you about…

Oh, and one more thing… when you sign up right now, there are two more special reports I’d like you to have for free.

The first is called The Essential Currency for Surviving a Monetary Crisis. It’s about another way to keep your money safe from the Government… while setting yourself up to make a lot of money too.

The other briefing is about a technique Doug has used for nearly 30 years to make money no matter what the markets are doing.

Check out the order form on the next page for more details.

Best Regards,

E.B. Tucker

March 2016